In a startling development, foreign banks are now insisting on a substantial 10% commission to endorse letters of credit (LC) for importable consignments, as disclosed by informed sources within the banking sector. This unprecedented move comes as Pakistan grapples with a host of economic challenges, eroding the confidence of global financial institutions in the country’s banking system.

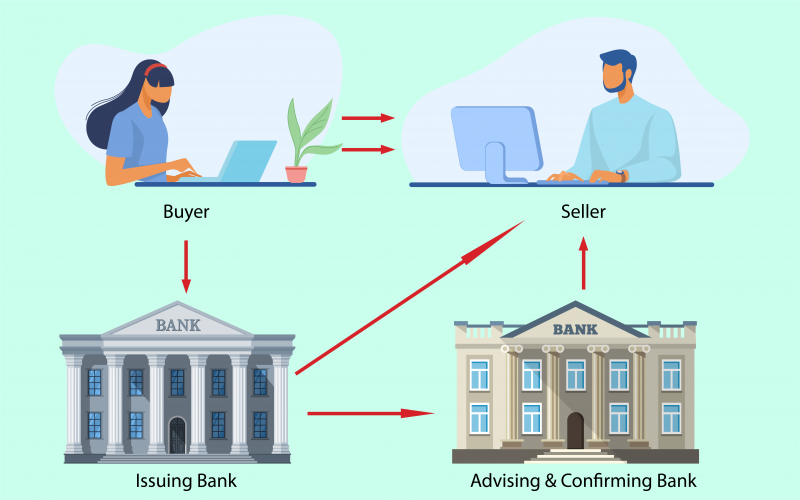

The depreciation of the rupee, coupled with concerns surrounding foreign exchange reserves and debt servicing, has elevated the business risks associated with conducting transactions in Pakistan. What further compounds the issue is that letters of credit issued by Pakistani banks are no longer deemed credible by international exporters. Instead, they require an endorsement from globally recognized foreign banks to proceed with confidence.

A senior banker emphasized the growing risks and the deteriorating economic situation in Pakistan, which has weakened the country’s image abroad. The cost of securing this endorsement has surged, with foreign banks now demanding a steep 10% commission on each consignment. This significant fee marks a stark contrast to the previous norms and is indicative of the skepticism surrounding the Pakistani banking sector.

The situation has been exacerbated by several factors, including the nation’s recent decision to lift import restrictions following a $3 billion loan agreement with the International Monetary Fund (IMF). However, the IMF’s directives, which aimed to liberalize imports and maintain a uniform currency exchange rate, appear to have backfired, intensifying Pakistan’s economic challenges.

The consequences of these developments are multifaceted. Foreign banks raising commissions, combined with the strengthening of the US dollar against the Pakistani rupee, have inflated import expenses. This, in turn, has triggered a ripple effect, causing the cost of imported fuel to surge due to the dollar’s appreciation. The subsequent increase in energy prices has led to a direct and inflationary impact on the nation’s poorer citizens.

Analysts and experts are increasingly concerned that the interim government may be ill-equipped to navigate these intricate financial dilemmas, especially given the backdrop of political instability, which further complicates matters.

Additionally, the unchecked smuggling of essential commodities like dollars, wheat flour, sugar, and fuel, alongside widespread corruption, has presented significant law-and-order challenges for the government. The unregulated foreign currency trade has allowed the open-market rate of the US dollar to soar by nearly 9% above the official banking rate, a disparity that far exceeds the IMF’s acceptable threshold of 1.25% under the loan agreement. This poses potential complications for Pakistan’s economic managers as they prepare to engage with the IMF team for an upcoming bailout review.

As Pakistan navigates these complex financial waters, it is imperative for stakeholders, including the government and financial institutions, to work collaboratively to find sustainable solutions that can restore confidence in the nation’s banking system and address the pressing economic challenges at hand.